IFSCA has been established with the objective to develop and regulate the financial services market in the IFSCs in India and for matters connected therewith or incidental thereto, as mentioned in the preamble of the IFSCA Act, 2019. One of the key regulatory functions of the IFSCA is to safeguard the interests of financial consumers. Ensuring consumer protection is crucial for maintaining trust and confidence in the financial markets within the IFSC. IFSCA recognises that robust consumer protection framework enhances long-term market integrity by holding financial service providers accountable, promoting responsible business practices, and contributing to the overall stability of the financial markets in the IFSC.

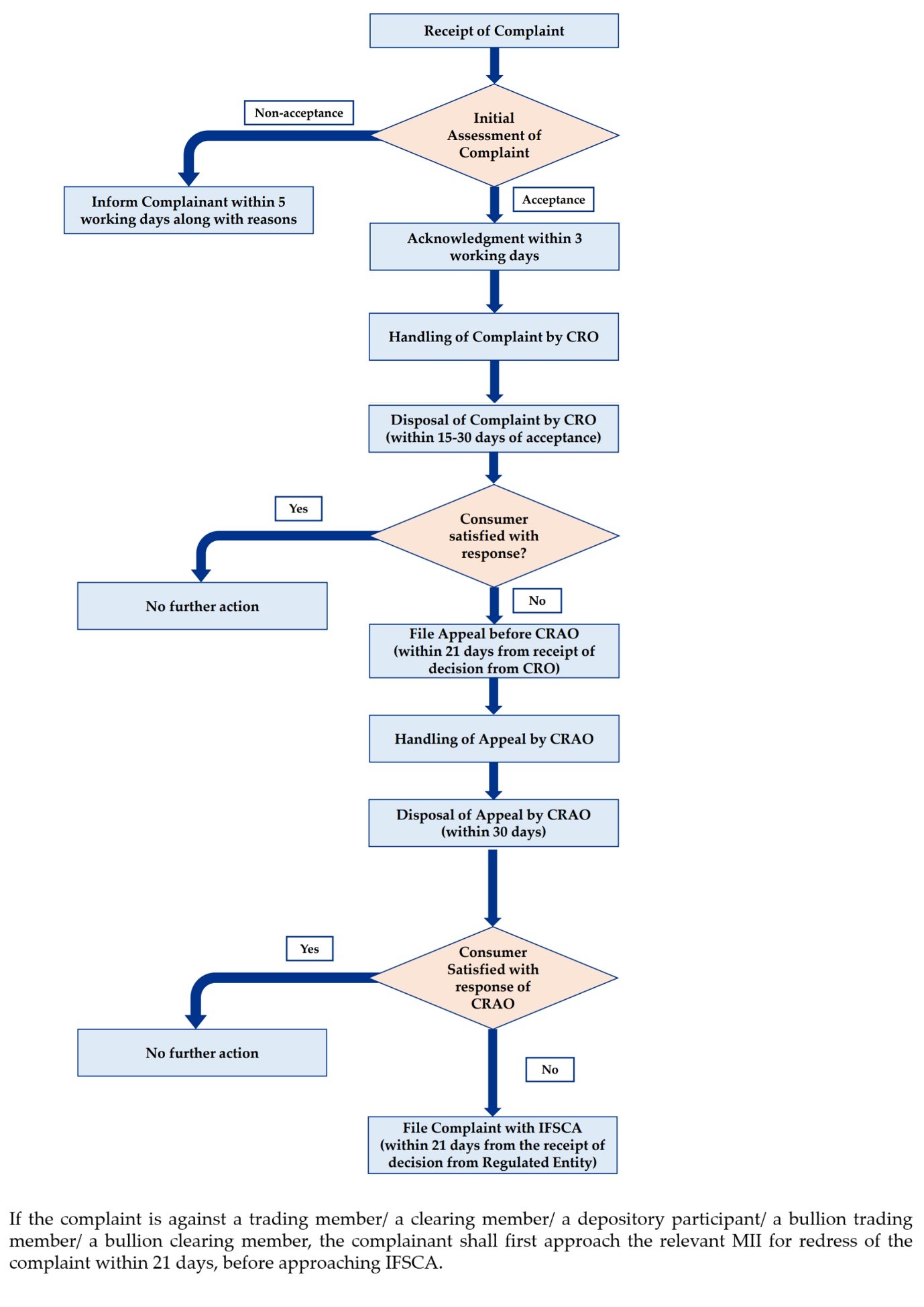

IFSCA has issued a circular on “Complaint Handling and Grievance Redressal by Regulated Entities in the IFSC” dated December 02, 2024, detailing the process for handling consumer complaints in IFSCs. Pursuant to Circular dated January 13, 2025, the said mechanism shall be effective with respect to April 01, 2025.

Fair and transparent handling of your complaints

Timely redressal of your grievances

Clear communication about the status of your complaint

Appeal against decisions you're not satisfied with

Be complete and specific

Include supporting documents

Relate to financial products/services provided by Regulated Entities in the IFSC

Appeal against decisions you're not satisfied with

Anonymous complaints (except whistleblower complaints)

Incomplete, vague or unspecific complaints

Allegations without supporting evidence

General suggestions or guidance requests

Complaints about unregistered/unregulated activities

Information requests about financial products

Read and understand all documentation before availing financial services

Keep records of all transactions and correspondence

Be aware of the complaint handling procedures of your financial service provider

Know the timelines for filing complaints and appeals

| Department/Division | Name and Designation | Telephone | Email ID |

|---|---|---|---|

| Division of Consumer Education and Protection | Praveen Trivedi, ED | 079-61809800 | praveent[dot]ed[at]ifsca[dot]gov[dot]in |

| Arjun Prasad, GM | 079-61809815 | arjun[dot]pd[at]ifsca[dot]gov[dot]in | |

| Akash Boddeda, AM | 079-61809909 | akash[dot]boddeda[at]ifsca[dot]gov[dot]in | |

| Nikhil, AM | - | nikhil[dot]solanki[at]ifsca[dot]gov[dot]in |

For filing a complaint with IFSCA, send an email:grievance-redressal[at]ifsca[dot]gov[dot]in

Always access the Directory from our website to see if an entity is registered or authorised or licensed with the Authority.

International Organization of Securities Commissions (“IOSCO”) receives alerts and warnings from its members regarding firms that are not authorized to provide investment services in the jurisdiction that issued the alert or warning. Some alerts may involve unauthorized firms using names similar to those of authorized firms or falsely claiming to be associated with regulated entities.

To help you stay informed about potential investment risks, IOSCO regularly updates the list of alerts and warnings on its I-SCAN page. Please visit the IOSCO ISCAN webpage:IOSCO I-SCAN

The International Financial Services Centres Authority (IFSCA) has been established to regulate and develop financial services in the International Financial Services Centres (IFSCs) located in India.