Consumer Protection

IFSCA has been established with the objective to develop and regulate the financial services market in the IFSCs in India and for matters connected therewith or incidental thereto, as mentioned in the preamble of the IFSCA Act, 2019. One of the key regulatory functions of the IFSCA is to safeguard the interests of financial consumers. Ensuring consumer protection is crucial for maintaining trust and confidence in the financial markets within the IFSC. IFSCA recognises that robust consumer protection framework enhances long-term market integrity by holding financial service providers accountable, promoting responsible business practices, and contributing to the overall stability of the financial markets in the IFSC.

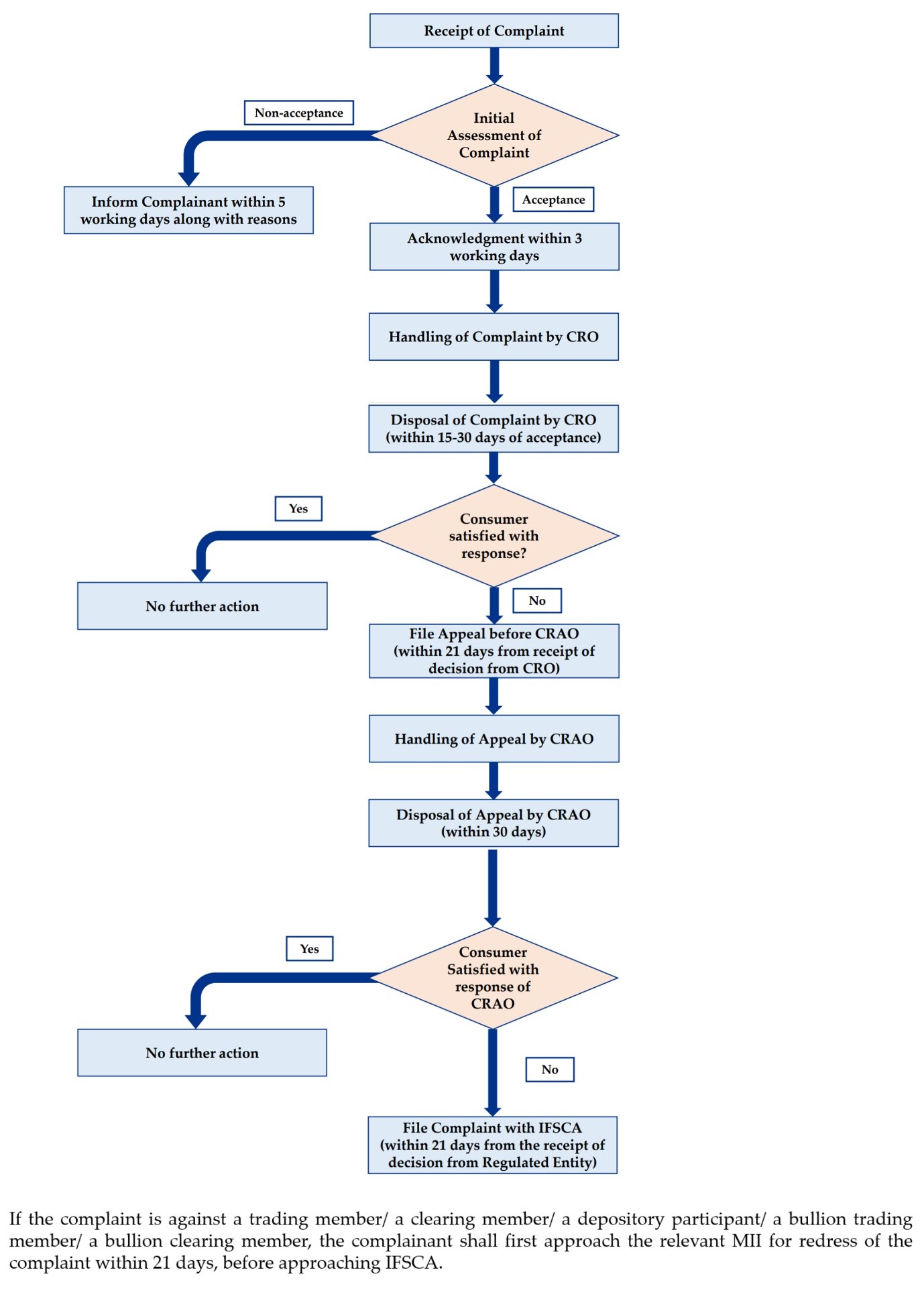

IFSCA has issued a circular on “Complaint Handling and Grievance Redressal by Regulated Entities in the IFSC” dated December 02, 2024, detailing the process for handling consumer complaints in IFSCs. Pursuant to Circular dated January 13, 2025, the said mechanism shall be effective with respect to April 01, 2025.

Your Rights as a Financial Consumer

As a financial consumer in the IFSC, you have the right to:

Complaint Resolution Process

What constitutes a valid complaint

Your complaint should:

What is NOT considered a complaint

Consumer Education

Understanding your rights and responsibilities as a financial consumer is crucial. We encourage you to:

| Department/Division | Name and Designation | Telephone | |

|---|---|---|---|

| Division of Consumer Education and Protection | Praveen Trivedi, ED | 079-61809800 | praveent[dot]ed[at] ifsca[dot]gov[dot]in |

| Arjun Prasad, GM | 079-61809815 | arjun[dot]pd[at] ifsca[dot]gov[dot]in | |

| Akash Boddeda, AM | 079-61809909 | akash[dot]boddeda[at] ifsca[dot]gov[dot]in | |

| Nikhil, AM | - | nikhil[dot]solanki[at] ifsca[dot]gov[dot]in |

For filing a complaint with IFSCA, send an email:grievance-redressal[at]ifsca[dot]gov[dot]in

The International Financial Services Centres Authority (IFSCA) has been established to regulate and develop financial services in the International Financial Services Centres (IFSCs) located in India.